1944

Graduated from Harvard University with a bachelor’s degree

1944

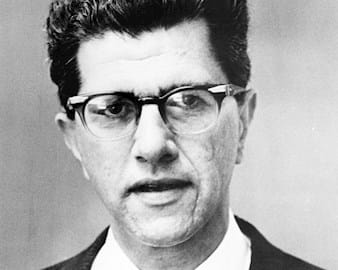

The late Merton H. Miller helped revolutionize corporate finance theory and the way corporations make financial decisions. His work with fellow economist Franco Modigliani, winner of the 1985 Nobel Prize in Economic Sciences, applied economic theories to financial operations, opening the door to a closer examination of how companies should operate.

Born in Boston in 1923, Miller grew up during the Great Depression. After earning his undergraduate degree in economics at Harvard University, he worked as an economist at the US Treasury Department and then at the Federal Reserve System before pursuing a PhD from Johns Hopkins University.

Miller’s fruitful collaboration with Modigliani began at Carnegie Mellon University, where Miller joined the faculty in 1953. In 1958, the pair published the first of several papers on corporate finance, outlining ideas that became known as the M&M theorem. Those ideas have served as the foundation of corporate finance theory ever since.

Their paper “The Cost of Capital, Corporation Finance and the Theory of Investment” challenged conventional views of corporate finance by demonstrating that the value of a firm depends on how it invests its resources—not on how it is financed. “If you take money out of your left pocket and put it in your right pocket, you are no richer,” Miller once said. “What counts is what you do with your money, not where it came from.”

Miller, a self-described “activist supporter of free-market solutions to economics problems,” served as a director of both the Chicago Board of Trade and the Chicago Mercantile Exchange. After the stock market crash of October 1987, he chaired a special panel to examine its causes.

Beyond economics, Miller was a longtime Chicago Bears football fan. In his autobiographical notes for the Nobel Prize, he wrote, “Unlike some of my more athletic fellow laureates, the closest I get to recreational exercise these days is watching the Chicago Bears from my season-ticket seats (17 years now) in the south end zone of frigid Soldier Field.”

“I learned more economics from two or three months’ worth of lunches with George Stigler than I learned in four years of college.”

—Merton H. Miller

Miller’s Nobel Prize–winning work revolutionized both the study of finance and the way in which corporations make decisions.

Graduated from Harvard University with a bachelor’s degree

1944

Earned PhD in economics from Johns Hopkins University

1952

Published the first of several papers on corporation finance with Franco Modigliani

1958

Joined the faculty at Chicago Booth

1961

Was named president of the American Finance Association

1976

Joined the Chicago Board of Trade as a public director

1983

Received the Nobel Prize in Economic Sciences for his contributions to the theory of corporate finance

1990

Merton H. Miller liked to tell a joke about Yogi Berra, the famous baseball catcher. Berra once told his trainer that he was particularly hungry, and he instructed him to cut his pizza into 12 pieces instead of six.

Why Merton Miller Remains MisunderstoodArchival images courtesy of the Hanna Holborn Gray Special Collections Research Center, University of Chicago Library.